So

what replaced the system that the founding fathers originally

intended? In 1913, the passage of the Federal Reserve Act granting the

Federal Reserve the legal authority to issue Federal Reserve Notes.

When President Wilson signed the bill, he declared it the “first of a

series of constructive acts to aid business”. In fact the only

business it aided was that of the private banks. The system was

designed from its inception to ensure that every dollar that came into

existence had to be borrowed from this private cartel of banks called

the Federal Reserve.

So what most people also do not know is that every

single dollar in circulation has to be borrowed by somebody. In other

words, the entire money supply is DEBT BASED and someone is paying

interest on that debt to the private bankers. In fact the total cost

for 2012 for just servicing the interest on the U.S. government debt

was an astounding $359 billion and $454 billion the year before. The

interest on our debt for those two years exceeds the entire stimulus

bill of 2009. Think of what we could do with that much money every

year: transportation, healthcare, modernizing the electric grid,

education, research, are just a few examples that quickly come to

mind.

It becomes very easy to see that the ability to collect

interest on the national debt involves huge sums of money being paid

out to those with the power to create our money and that these people

will do almost anything to make sure that things remain exactly as

they are. That is why they encourage their corporate controlled media

to ridicule the $trillion coin idea as something out of a fantasy

tale, or having the talking heads echoing that investors will be

spooked, and broadcasting that the world will think that the U.S. has

totally lost its marbles.

The question NOT being asked by the corporate media

shills is that if the U.S. government can issue its own interest free

money in the form of a $trillion coin, then why is it borrowing the

money at interest instead?

One can therefore think of the idea of issuing a

$trillion dollar coin as being equivalent to the idea of the

government printing its own money. The philosophy and result are

essentially the same.

Think about this: if you had the LEGAL right to print your own money would you:

1. print your own money to pay your bills?2. borrow money at interest from the private banks to pay your bills?

Of course any sane person would print their own money.

Yet here we have the unimaginable stupidity of a government with the

ability to print its own interest and debt free money. Instead chooses

to borrow that money at interest. Astoundingly, the corporate

controlled media is not asking why this practice continues.

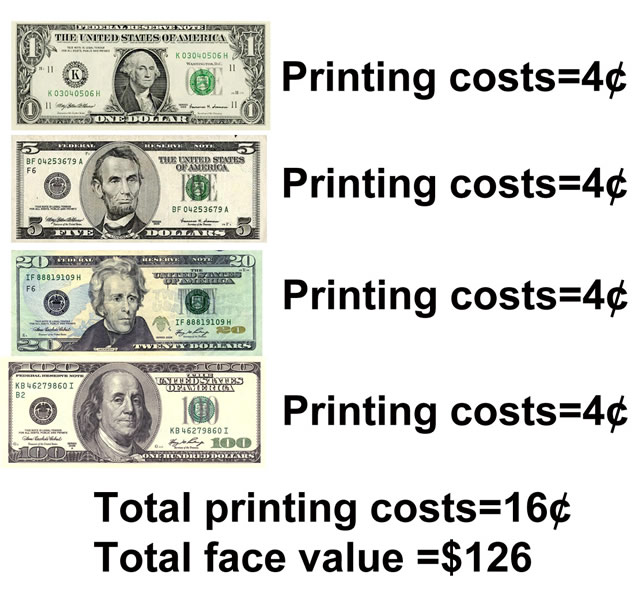

It

actually gets even worse. It costs the government 4 cents to print a

bill of any denomination, for the paper, labor, ink equipment

maintenance etc. It does not matter whether the bill is $1, $5, $20,

or $100, the cost is the same. So if you were the one printing this

legal money, the last 4 bills mentioned would have cost you 16 cents to

print. Now can you imagine the totally absurd notion of you taking

these 4 bills to your banker, selling it to them for the cost of

printing (16 cents), and then borrowing it back at face value ($126)

with interest charges? This is the height of lunacy, and yet this is

exactly what our government does. The Treasury Dept prints the bills,

delivers them to the Federal Reserve branch offices, charges them for

the cost of printing, and then borrows this money back at face value

with interest. Ask yourself why the corporate controlled media is not

covering this story.

Henry Ford once wrote: “It is well enough

that people of the nation do not understand our banking and monetary

system, for if they did, I believe there would be a revolution before

tomorrow morning.”

The fatal flaw

in our monetary system is that every dollar has to be borrowed into

existence, then this money is extinguished once the loan is paid back.

So there is a balance here? Wrong! If you borrow $1000, you add $1000

to the money supply. When you pay the loan back, you extinguish the

$1000. The problem is where does the money to pay the interest come

from? There is not enough money in circulation to repay both the

principal and the interest. This lies at the very heart of our deficit problem.

Someone has to borrow money into circulation to cover the costs of

your interest payments. The amount of debt in our system must continue

to grow in order to service the interest payments on the original debt.

So the more the debt grows, the more interest payments needed, the

more that must be borrowed to pay that interest, the more debt grows.

The fact the U.S. is trillions in deficit is by design. In reality it

is impossible to repay this debt. When you hear those clueless people

talking about paying off the debt, it cannot be done. If we paid off

the entire debt, we would have no money in circulation.

Pretty

clever system these money masters have created for themselves,

keeping the nation and its people in perpetual debt slavery and

getting paid interest for something they created out of thin air,

something they never owned, something the Constitution never gave

them the right to do. The result of the unsustainability of our

current system is that ultimately the amount of debt overhang will

become so huge that the system will collapse in on itself. There are

many including myself who believe that we are approaching that end

point.